vehicle coverage plans that favor lasting value

Clarity before crisis

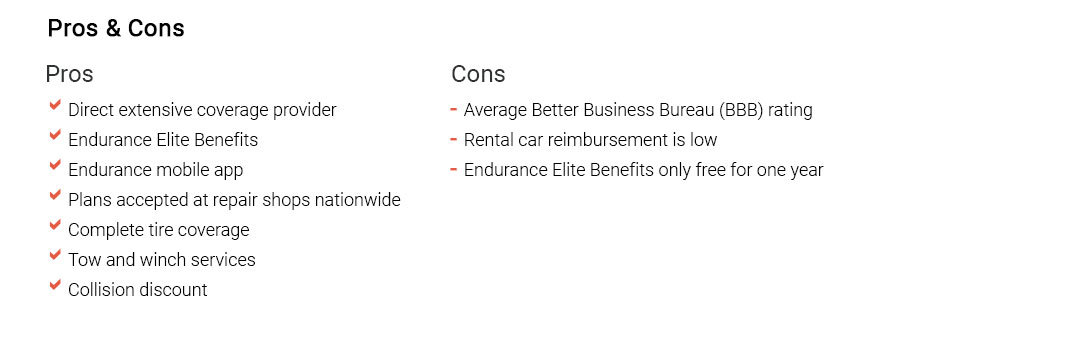

Quality-first protection is less about bells and more about stability. You want coverage that holds steady on expensive days, and stays modest on ordinary ones. The pieces below combine differently depending on your car, region, and risk tolerance.

Core layers

- Liability covers injuries and property you cause. It's the backbone for financial stability.

- Collision repairs your car after a crash, even if fault is unclear.

- Comprehensive handles non-crash losses: theft, storms, glass, animals, fire.

- Uninsured/Underinsured fills gaps when the other driver's limits run out.

- Medical payments or PIP cushions medical costs regardless of fault.

Useful add-ons

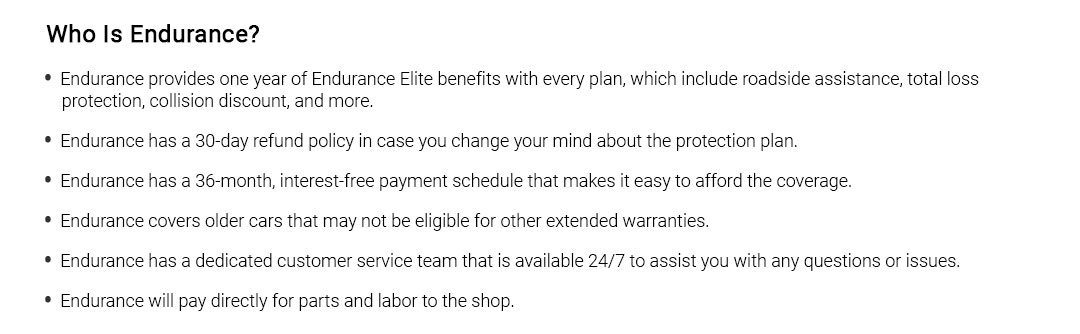

- Roadside and towing for blowouts and dead batteries.

- Rental reimbursement so mobility continues while repairs happen.

- Gap coverage to bridge loan balance after a total loss.

- New car replacement for early-ownership peace of mind.

Small, real moment: a Tuesday commute, a gravel truck, a sudden crack across the windshield. Comprehensive steps in, the shop schedules the fix, and your week stays on track.

Balancing choices

Higher deductibles trim premiums; higher limits protect savings. There's a middle ground, though it can feel like guesswork. Plans differ by state, underwriting, and timing, and terms may shift quietly at renewal. Read the exclusions, check OEM parts language, and confirm how total losses are valued.

To explore options, compare a few scenarios: the cost of a minor fender repair, a hailstorm, a medical bill. Pick coverage that keeps those moments survivable without straining cash flow. That is the steady kind of value.